Hey there, awesome visitor! 👋 Our website is currently undergoing some nifty upgrades to serve you even better. But don't worry, we'll be back before you can say "SearchMyExpert rocks!"

Embracing the Power of Mobile Payment Solutions

The transition from physical to digital storefronts has seen businesses gravitating towards mobile apps with integrated payment solutions. Such integration not only offers customers a frictionless payment experience but also strengthens brand credibility.

Benefits of Mobile Payment Gateway Integration:

- Boost in Conversion Rates: Simplified payment processes can lead to higher conversion rates. Apps typically outperform mobile sites threefold in conversion rates.

- Enhanced User Experience: An integrated payment gateway allows users to complete their transaction without ever leaving the app. This can significantly boost user retention and repeat business.

- Strengthened Brand Image: A seamless payment experience resonates with your brand's promise of quality and convenience, thereby enhancing brand perception.

Key Features to Evaluate in Your Mobile Payment Gateway

1. Merchant Account Types:

- Dedicated Account: Exclusive to your business. Offers greater control over transactions but may come with higher costs.

- Aggregate Account: Shared among various businesses. Easier setup and generally more cost-effective.

2. Payment Gateway Models:

- Hosted Off-site: Redirects users to another site for payment. Might affect user experience and conversion tracking.

- Integrated Gateways: Integrated into your app using APIs. Ensures seamless user experience and better conversion tracking.

3. API Customization:

Payment gateway APIs like those offered by leading providers ensure custom integrations, offering functionalities like recurring payments, invoice generation, and more.

4. Recurring Billing Support:

Essential for businesses offering subscription-based services.

5. Multi-currency & Crypto Support:

For businesses aiming at global markets, supporting multiple currencies and cryptocurrencies can be a unique selling point.

6. Robust Security:

Features like PCI DSS compliance, data encryption, tokenization, and fraud prevention are non-negotiable to ensure safe transactions.

7. Scalability:

As your transactions grow, your payment gateway should adapt without hiccups.

Top Contenders in Mobile Payment Gateway Arena

- Stax: Known for its developer-friendly API and comprehensive features like recurring billing.

- Braintree: Offers a robust API and features like fraud prevention.

- PayPal: A global leader offering holistic solutions for online and mobile payments.

- Stripe: Popular for its API and comprehensive features, including an intuitive SDK.

- Adyen: Offers a robust API and features like multi-currency support.

- Authorize.net: Widely used in North America with comprehensive payment solutions.

A Concise Roadmap to Integrate Payment Gateways

- Merchant Account Setup: Choose between dedicated or aggregate based on your business needs.

- Payment Gateway Account Creation: Connect it to your merchant account.

- API Credentials Procurement: Generate the necessary credentials for app integration.

- Configure Your Payment Gateway: Define payment types, set up fraud prevention tools, etc.

- Integrate into Your App: Using the provided code snippets and documentation, embed the gateway into your app.

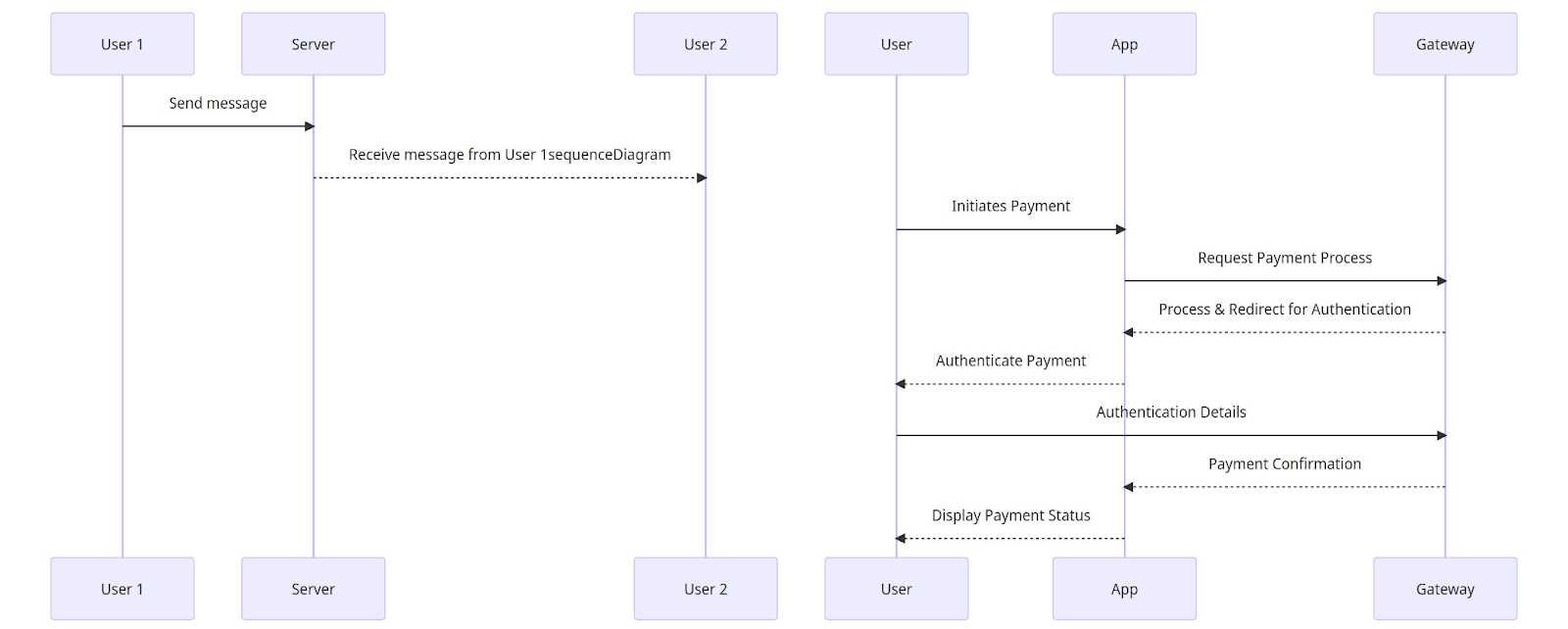

The diagram above visually represents the process between the user, the mobile application, and the payment gateway during a transaction process. The seamless flow ensures that the user remains in the app environment, thus enhancing user experience and trust.

Evaluating the Costs of Mobile Payment Gateway Integration

Understanding the associated costs is pivotal when selecting a mobile payment gateway. These costs can significantly influence your ROI and customer pricing strategy.

1. Setup Fees:

Many payment gateways have an initial setup fee, but some might waive this for larger businesses or promotional offers.

2. Transaction Fees:

This is a fee charged per transaction, which might vary based on the transaction volume. Some gateways offer tiered pricing based on the number of transactions.

3. Monthly or Annual Fees:

Some providers charge a recurring fee for using their services, regardless of the number of transactions.

4. Additional Feature Costs:

Advanced features like fraud protection, multi-currency support, or premium support might come with additional costs.

5. Chargeback Fees:

In case a customer disputes a transaction, gateways might charge a fee to handle the dispute process.

The Importance of Customer Support

An often underlooked aspect of payment gateways is the quality of customer support. As transactions involve sensitive financial data, any hiccup can lead to customer mistrust. Hence, having a responsive and efficient support team can make all the difference.

- 24/7 Availability: Transactions occur round the clock. Ensure your provider offers 24/7 support to address any issues promptly.

- Multiple Communication Channels: Offering support via email, phone, and live chat can expedite resolution.

- Knowledge Base & Documentation: A comprehensive set of FAQs, guides, and tutorials can help both businesses and customers resolve common queries without direct support intervention.

The Future of Mobile Payment Gateways

With technological advancements, the landscape of mobile commerce and payment gateways is continuously evolving. Here are some trends to look out for:

- Biometric Authentication: With smartphones equipped with fingerprint and facial recognition, biometric authentication might become standard for transactions, enhancing security.

- AI & Machine Learning: These technologies can be leveraged for better fraud detection and personalized user experiences.

- Blockchain & Cryptocurrencies: As cryptocurrencies gain mainstream acceptance, more gateways might offer them as standard payment options.

- Integration with IoT: As the Internet of Things (IoT) grows, payment gateways could be integrated into wearable devices, smart appliances, and more.

Best Practices for Mobile Payment Gateway Integration

When it comes to integrating a payment gateway into your mobile app, a methodical approach is pivotal. Let's delve into some best practices that ensure a seamless and secure transaction experience for your users.

1. User-Centric Design:

Prioritize the user's experience. The payment process should be as intuitive and straightforward as possible. Fewer steps generally lead to better conversion rates. Remember, a user-friendly interface can be a make-or-break factor for many customers.

2. Opt for a Mobile-Optimized Gateway:

Ensure the gateway is optimized for mobile transactions. A mobile-optimized gateway reduces loading times and ensures that payment pages display correctly across various screen sizes.

3. Regular Updates & Maintenance:

Payment systems evolve rapidly. Regularly update the gateway integration to benefit from the latest security patches, features, and improvements.

4. Data Encryption:

Ensure all transaction data is encrypted. Using technologies like SSL (Secure Socket Layer) ensures data transferred between the app and the gateway remains confidential.

5. Transparent Pricing & Charges:

Clearly communicate all charges associated with transactions. Hidden fees can deter users and tarnish your brand's reputation.

6. Testing is Key:

Before launching, rigorously test the payment process. Utilize sandbox environments offered by gateways to simulate transactions and identify any potential hiccups.

7. Offer Multiple Payment Options:

Cater to a wider audience by providing multiple payment methods – credit/debit cards, e-wallets, bank transfers, and more.

Navigating Global Transactions

For businesses aiming to tap into international markets, understanding global transaction dynamics is crucial.

- Local Currency Support: Offering payments in local currencies can boost trust and conversions. Customers are more likely to transact when prices are displayed in familiar currency formats.

- Cultural Sensitivities: Familiarize yourself with the preferred payment methods in different countries. For instance, while credit cards might be popular in the USA, other regions might prefer digital wallets or direct bank transfers.

- Compliance & Regulations: Each country has its own set of regulations and compliance standards. Ensure your gateway adheres to these to avoid legal complications.

Conclusion

In wrapping up, it's clear that the right payment gateway integration can be a game-changer for businesses. It's not just about accepting payments but creating a seamless, secure, and efficient experience for users. As technology evolves, businesses should remain agile and adapt to offer their customers the best in mobile commerce.

Why wait? The best

Mobile App Developers are just a click away.

Other Related Blogs

Mastering Docker for App Development: A Comprehensive Guide to Benefits, Use-Cases, and Alternatives

STAY UP TO DATE

GET PATH'S LATEST

Receive bi-weekly updates from the SME, and get a heads up on upcoming events.

Contact Us

We will get back to you as soon as possible.

Please try again later.

Find The Right Agencies

SearchMyExpert is a B2B Marketplace for finding agencies. We help you to describe your needs, meet verified agencies, and hire the best one.

Get In Touch

WZ-113, 1st Floor, Opp. Metro Pillar No- 483, Subhash Nagar - New Delhi 110018

About Us

For Agencies

Benefits Of Listing With Us

Submit An Agency

Agency Selection Criteria

Sponsorship

For Businesses

Agencies Categories

Trends Articles

FAQs

Find The Right Agencies

SearchMyExpert is a B2B Marketplace for finding agencies. We help you to describe your needs, meet verified agencies, and hire the best one.

About Us

For Agencies

List Your Agency

Benefits Of Listing

Agency Selection Criteria

Sponsorship

Get In Touch

WZ-113, 1st Floor, Opp. Metro Pillar No- 483, Subhash Nagar - New Delhi 110018

contact@searchmyexpert.com

Copyright © 2023 · Skillpod Private Limited · All Rights Reserved - Terms of Use - Privacy Policy